Free Resources to Help You Relieve Stress, Restore Energy and Elevate Your Performance & Impact

Everything here has one purpose: To uplift high achievers, leaders, and changemakers to stay well - without sacrificing their ambition or impact.

Explore the tools, videos, and insights that have helped thousands of people feel better, think clearer, and perform sustainably.

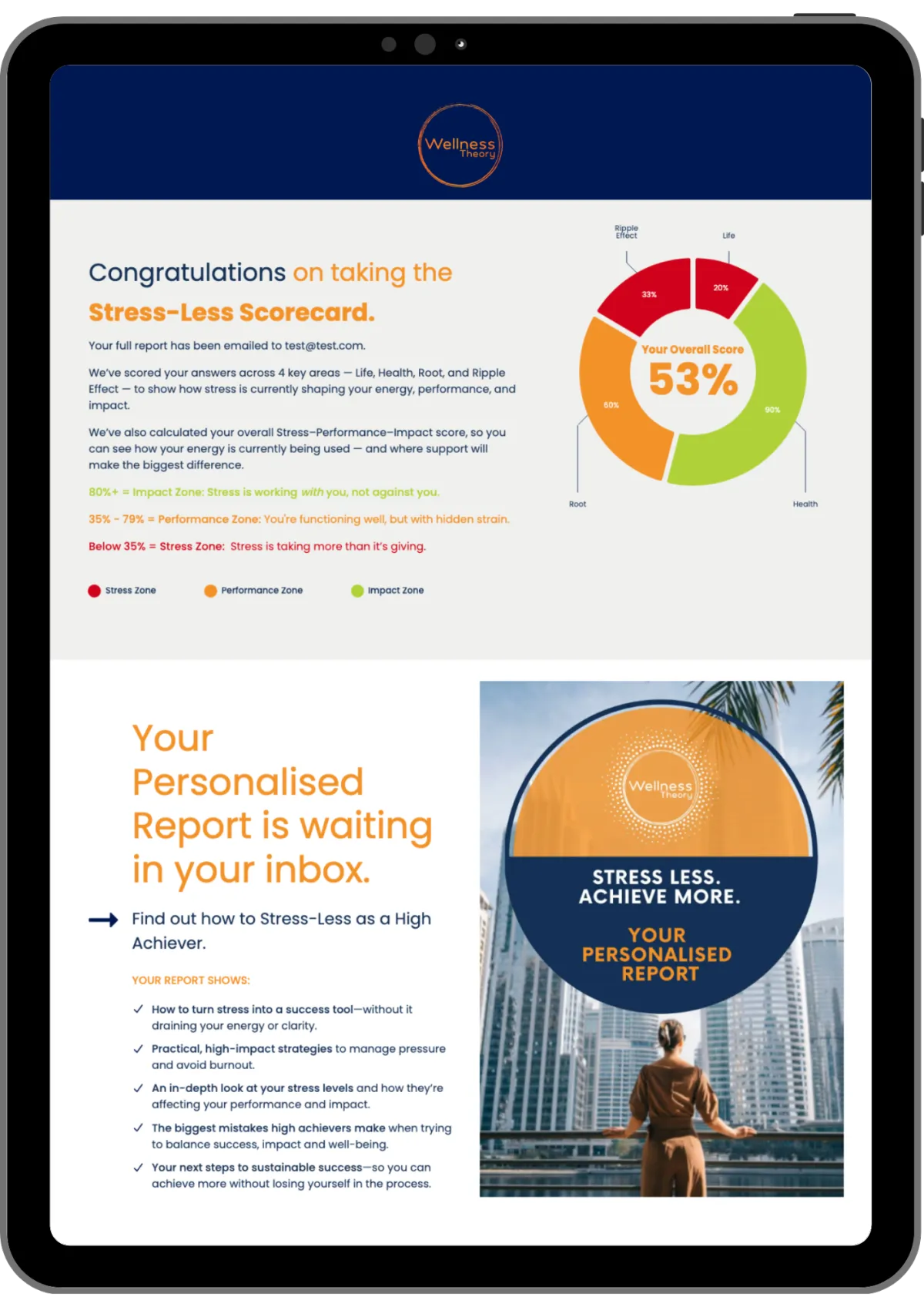

Take The Stress-Less Scorecard

Your 3-minute personalised snapshot of how stress is shaping your performance, energy, and impact.

This tool reveals:

Where stress is affecting your clarity, energy, or emotional health

Whether you're operating in the Stress, Performance, or Impact zone

What’s driving overwhelm, burnout, or over-functioning

What to do next to feel better and perform sustainably

The Stress-Less Scorecard

Your 3-minute personalised snapshot to understand your Stress–Performance–Impact Zone.

This tool reveals:

Where stress is affecting your clarity, energy, or emotional health

Whether you're operating in the Stress, Performance, or Impact zone

What’s driving overwhelm, burnout, or over-functioning

What to do next to feel better and perform sustainably

Case Studies & Success Stories

Real People. Real Change. Real Transformation.

These stories show how people redesigned stress, performance, and responsibility - without losing themselves or their impact.

Curious what this could look like for you?

Articles

Articles for High Achievers, Leaders & Changemakers

7 Common Stress Relief Mistakes (and What to Do Instead)

Stress relief not working anymore? Discover 7 common stress relief mistakes and what actually helps reduce stress in a sustainable way. ...more

Stress, Performance & Wellbeing

January 05, 2026•5 min read

Stress Leaves Clues – Are You Listening?

Stress leaves clues in your body, thoughts, and behaviour. Learn how to recognise the signs and use the LISTEN Method™ before stress escalates. ...more

Stress, Performance & Wellbeing

January 05, 2026•7 min read

21 Scientifically Proven Hacks to Reduce Stress Instantly

Discover 21 scientifically proven hacks to reduce stress instantly, calm your nervous system, and know when quick relief isn’t enough. ...more

Stress, Performance & Wellbeing

January 05, 2026•7 min read

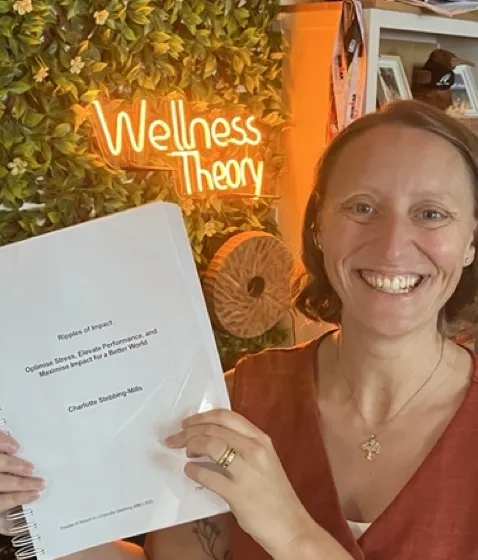

Get a First Look at Charlotte’s Upcoming Book

RIPPLES OF IMPACT

Ripples of Impact explores how to break free from stress and burnout cycles, unlock sustainable performance, and create ripple effects of wellbeing that reach beyond you.

This book is for you if…

You want to perform at your best without sacrificing your wellbeing.

You’re ready to break free from burnout cycles that keep you stuck.

You believe wellbeing and impact can — and should — go hand in hand.

You’re a changemaker, leader, or high achiever ready to thrive sustainably.

You want your wellbeing to support your work, not sit alongside it

About your Author

Charlotte Stebbing-Mills

Charlotte is a Wellbeing Specialist, Podcast Host, and Co-Founder of The Wellness Theory. With over two decades of experience, she has helped thousands of high achievers, leaders, and organisations worldwide turn stress into strength. Featured in Arabian Business, CEO Middle East, and Gulf News, her work blends lived experience with proven frameworks to unlock performance, wellbeing, and impact that lasts.

Ready to understand how stress is shaping your performance and impact?

Discover Your Stress-Performance-Impact Profile

through the Stress-Less Scorecard — our 3-minute assessment for high achievers, leaders, and quiet changemakers.

The Stress-Less Scorecard reveals:

Where stress is draining your clarity, mood, or energy

Whether you're in the Stress, Performance, or Impact Zone

The patterns fuelling overwhelm or over-functioning

How your wellbeing influences the people you lead and love

What to do next, based on personalised guidance

QUICK LINKS

LEGAL

FOLLOW US

Copyright 2025. Abu Dhabi, UAE. All Rights Reserved.

Instagram

LinkedIn

Youtube